views

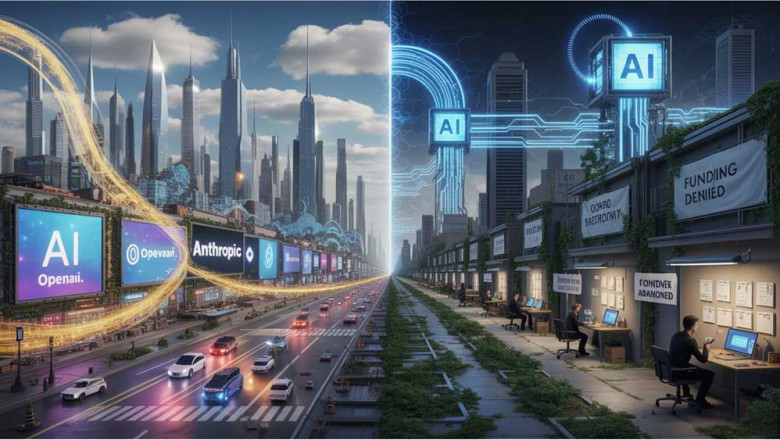

The PitchBook data highlights a paradox that is redefining the venture capital landscape in 2025. On one hand, AI startups are experiencing explosive growth in funding; on the other, many traditional VC funds are struggling to raise capital. This is more than a contradiction — it reveals deeper dynamics of extreme concentration, systemic volatility, and structural imbalance.

Growth That Conceals Fragility

In the first half of 2025, U.S. startups collectively raised $162.8 billion, marking a 75.6% increase compared to the same period in 2024 — the second-highest first-half total ever recorded. However, as is often the case, aggregate numbers don’t tell the full story.

Over 64% of this capital flowed into artificial intelligence, with a significant portion going to just five companies, which together raised more than a third of all Q2 VC funding. These include names like OpenAI, Anthropic, Groq, and CoreWeave — projects attracting single funding rounds exceeding $10 billion.

Meanwhile, traditional venture capital funds are facing severe challenges. In the same period, only $26.6 billion was raised across 238 U.S. VC funds, representing a 34% drop from the year prior. The average time to close a fund has increased to 15.3 months — a clear signal of institutional investor (LP) hesitancy due to a lack of significant exits and ongoing uncertainty.

Venture Capital or Project Finance?

What we’re seeing today no longer resembles classic venture capital. The scale of funding, the infrastructure-like nature of the investments, and the heavy concentration on a handful of players point to a shift toward a project finance model. Investors are no longer betting on new ideas — they are backing dominant platforms managing global data, compute infrastructure, and language models.

This dynamic risks cannibalizing the broader innovation ecosystem, draining capital away from critical sectors like climate tech, digital health, biotech, and advanced manufacturing. The result? Innovation becomes less distributed, less pluralistic, and more vulnerable to speculative bubbles.

Exits: Signs of Life, But Still Too Weak

Some IPOs and M&A deals — such as those involving CoreWeave and Hinge Health — may help restore LP confidence and unlock new liquidity for funds. However, many funds launched during the 2020–2021 boom remain underwater, and exit activity is still too narrow to reset the cycle.

The lack of liquidity is fueling a vicious cycle:

fewer exits → less trust → weaker fundraising → more concentration → greater systemic risk.

What’s Next? Strategic Reflections

If this concentration trend continues, investment models will need to evolve. We may see a polarized future: on one side, mega-funds focused on AI and cloud; on the other, smaller sectoral, regional, or impact-driven funds designed to support overlooked niches.

Alternatively, new hybrid models may emerge — combining artificial intelligence, direct digital engagement (such as iPhygital iTV Channels), and decentralized financial tools (like NNFTs or smart subscriptions) to democratize access to capital.

Three key takeaways:

-

The AI boom is real, but it does not reflect the overall health of the innovation ecosystem.

-

Venture capitalists must rebuild trust with LPs by demonstrating solid returns and agility in adapting to new cycles.

-

The future of VC belongs to those who can balance vision, discipline, and diversification — without being swept up in the AI frenzy.

Final thoughts

We are at a crossroads. 2025 could be remembered as the year AI exploded — or as the year when venture capital began to lose its soul, giving way to a less inclusive and more oligopolistic form of finance.

Our task is to recognize the enormous potential of artificial intelligence, while actively preserving an entrepreneurial ecosystem that is open, distributed, and pluralistic — where even those who aren’t building foundation models still have a meaningful role and a viable future.

Comments

0 comment