views

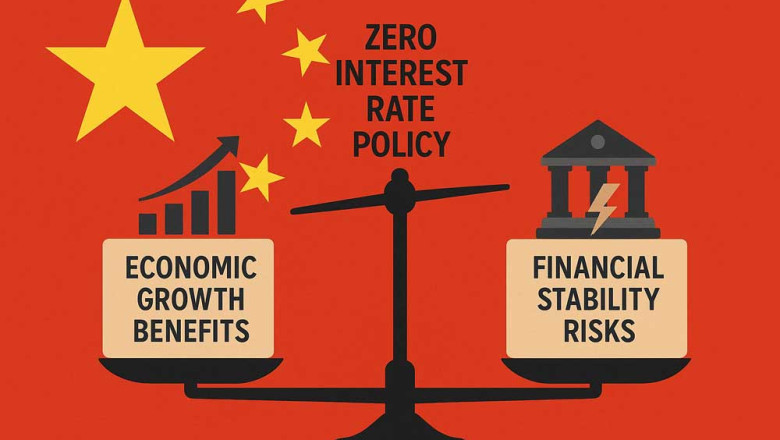

China's macroeconomic landscape has been evolving under various pressures including subdued domestic demand, trade tensions, and lingering debt challenges. The debate over whether China should adopt a zero interest rate policy centers on balancing the need to stimulate economic growth against potential risks to financial stability and market dynamics.

Current Monetary Context in China

-

China has recently implemented a series of interest rate cuts and monetary easing measures to bolster its economy. In 2025, the People's Bank of China (PBOC) has reduced lending rates and the reserve requirement ratio, releasing significant liquidity into the market to support growth and innovation-driven development.

-

The seven-day reverse repurchase rate was lowered slightly from 1.5% to 1.4%, and lending rates for rural development and small enterprises were cut as well, indicating an accommodative but cautious stance by monetary authorities.

-

Major state-owned banks have also reduced deposit rates, with some one-year fixed deposit rates falling below 1%, signaling an ongoing trend toward low rates amid deflationary pressures and debt concerns at regional government levels1234.

Arguments for Zero Interest Rate Adoption

-

Stimulate Economic Growth: Zero interest rates theoretically reduce borrowing costs to near free, which can encourage investment, corporate profitability, and consumption—key drivers for reviving economic confidence, especially in times of slowing growth and weak demand.

-

Respond to Deflation Risks: Persistent deflationary pressures in China make lower rates attractive to avoid stagnation and encourage spending.

-

Support Debt-burdened Regions: Many local governments and enterprises face high-interest debt that compounds rapidly, so lowering rates toward zero could ease fiscal stress and reduce the risk of defaults.

-

Policy Alignment: Other major economies have approached or implemented zero (or near zero) rates during downturns, suggesting that China could similarly benefit by aligning with global monetary trends during growth challenges56.

Risks and Challenges of a Zero Interest Rate Policy

-

Financial System Stability: Ultra-low rates compress bank profit margins, which may destabilize the banking sector, especially since Chinese banks have exposure to risky state-owned enterprises (SOEs) and speculative real estate markets.

-

Asset Bubbles: Lower rates can contribute to overheating in asset markets, exacerbating real estate bubbles and encouraging excessive risk-taking among investors.

-

Limited Monetary Policy Space: Moving to zero rates reduces the central bank’s ability to further cut rates in future downturns, potentially trapping China in a liquidity issue similar to a liquidity trap seen in other economies.

-

Capital Flow and Currency Impact: Low or zero interest rates may lead to capital outflows or currency depreciation pressures, complicating exchange rate stability efforts.

Recent Assessments and Outlook

-

Recent reports indicate that China's interest rates remain above zero, with the PBOC still having room to maneuver rate cuts further before hitting the effective zero lower bound.

-

The PBOC’s policy approach has been described as "appropriately accommodative," emphasizing macroeconomic stability and high-quality development alongside careful use of monetary tools, rather than aggressive rate cuts to zero.

-

The economic growth rate in China remains moderate but stable, with some sectors showing resilience despite global headwinds. This has led to debate whether a zero interest rate is immediately necessary or if incremental cuts combined with structural reforms would be more effective.

-

Analysts note the risks of rapid adoption of zero interest rates without addressing underlying structural challenges, such as local government debt, real estate market volatility, and capital market reforms78910.

Final thoughts

While adopting a zero interest rate policy could provide a strong stimulus to China’s economy by lowering borrowing costs and boosting confidence, the decision carries significant risks including bank profitability erosion, financial system stability, and asset bubble creation. The PBOC’s current strategy of gradual rate reductions and targeted monetary tools suggests a preference for cautious accommodation rather than an outright move to zero rates.

The decision hinges on balancing immediate growth needs with long-term financial stability, managing debt risks, and maintaining market confidence. It is likely that China may continue incremental rate cuts and other supportive measures rather than adopting a zero interest rate immediately, while closely monitoring economic indicators and global conditions.

References:

1 PBOC interest rate cuts and policy updates, May 2025

5 Commentary on China's move toward zero interest rates, Caixin, May 2025

2 China’s 10-point monetary package to stabilize markets, May 2025

3 Reuters report on China’s rate cuts, May 2025

4 Market reaction and analysis of China’s rate cuts, May 2025

7 PBOC Monetary Policy Committee meeting insights, March 2025

8 Reuters: China's policy rate limits discussion, January 2025

9 China Monetary Policy Report Q1 2025

6 Study on impact of China’s low interest rates, 2024

10 Recent economic growth outlook and stimulus pressure, JulyJuly 2025

- http://www.pbc.gov.cn/en/3688110/3688172/5552468/5701500/index.html

- https://www.china-briefing.com/news/china-10-point-monetary-package-market-stabilization/

- https://www.cnbc.com/2025/05/07/china-to-cut-key-lending-rates-by-10-points-bank-reserve-requirement-ratio-by-50-points-.html

- https://www.reuters.com/business/finance/china-cuts-key-rates-aid-economy-trade-war-simmers-2025-05-20/

- https://www.caixinglobal.com/2025-05-27/commentary-is-china-headed-for-a-zero-interest-rate-era-102323681.html

- https://www.shs-conferences.org/articles/shsconf/pdf/2024/27/shsconf_icdeba2024_04024.pdf

- http://www.pbc.gov.cn/en/3688229/3688311/3688329/5638400/index.html

- https://www.reuters.com/world/china/china-central-bank-is-moving-faster-towards-its-policy-limits-2025-01-10/

- http://www.pbc.gov.cn/en/3688229/3688353/3688356/5624504/5742611/index.html

- https://www.bloomberg.com/news/articles/2025-07-13/china-s-growth-seen-outpacing-target-easing-stimulus-pressure

- https://sites.lsa.umich.edu/mje/2025/01/08/whats-the-impact-of-the-fed-interest-rate-cut-on-the-chinese-investment-market/

- https://x.com/fteconomics/status/1945681410406101096

- https://www.ft.com/content/442112c4-7760-407c-b985-649846e9dbff

- https://www.reddit.com/r/ChunghwaMinkuo/comments/1m20sh1/should_ccp_adopt_a_zero_interest_rate/

- https://www.fitchratings.com/research/sovereigns/china-set-for-more-rate-cuts-seven-day-reverse-repo-now-key-policy-rate-29-05-2025

- https://sccei.fsi.stanford.edu/china-briefs/why-do-chinas-banks-lend-failing-soes-effect-lending-targets-bad-debt-and-economic

- https://newstral.com/en/article/en/1268967479/should-china-adopt-a-zero-interest-rate-

- https://www.cnbc.com/2025/07/15/chinas-second-quarter-gdp-growth-slows-to-5point2percent-as-economists-warn-of-mounting-headwinds-ahead.html

- https://www.richmondfed.org/publications/research/economic_brief/2024/eb_24-12

- https://viewpoint.bnpparibas-am.com/china-needs-qe-think-again/

Comments

0 comment