views

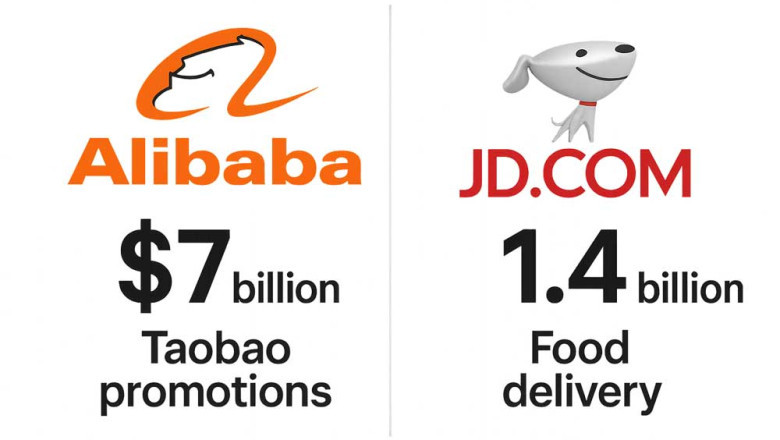

China's largest e-commerce giants, Alibaba and JD.com, are intensifying their competition to become the country's leading "everyday app"—the indispensable gateway for consumers’ daily needs. Both firms are rolling out immense promotional campaigns with the goal of capturing market share in the fast-growing instant retail and food delivery sectors.

Alibaba's $7 Billion Taobao Blitz

-

Investment Details: Alibaba has committed $7 billion (50 billion RMB) in direct subsidies over 12 months to supercharge promotions through its Taobao platform. These incentives are distributed to both consumers and merchants, aiming to drive usage of Taobao's "flash purchase" and instant retail features.

-

Promotion Mechanisms:

-

Large-value discounts and digital "red envelopes"

-

Subsidies on product prices, delivery fees, and store commissions

-

Free-order cards and special fixed-price deals

-

-

Strategic Goals:

-

Stimulate consumer spending amid a sluggish economy and deflationary pressure

-

Attract new users to Taobao's instant commerce ecosystem, especially Taobao Shangou, which promises rapid delivery (often under 60 minutes)

-

-

-

Strengthen Taobao's position against rising rivals in food and everyday commerce

-

JD.com's $1.4 Billion Food Delivery Push

-

New Investment: JD.com is allocating $1.4 billion (10 billion RMB) to expand its food delivery business nationally, primarily through aggressive consumer discounts and merchant incentives.

-

Key Tactics:

-

Deep price subsidies on meals and groceries, with some coffee and bubble tea offers as low as 1.68 yuan

-

No-commission policies for partner restaurants

-

Hiring bonuses targeting tens of thousands of new full-time delivery drivers

-

-

Expansion Efforts:

-

JD.com’s food delivery volume has rapidly grown, reaching over 25 million daily takeout orders in a matter of months—more than half the volume of Alibaba’s Ele.me.

-

-

-

Aims to use its logistics prowess to challenge incumbent leaders such as Meituan, integrating food delivery into JD’s larger digital ecosystem

-

Battle for the "Everyday App"

Both Alibaba and JD.com view food delivery and instant commerce as critical strategies to boost user engagement and frequency—users who buy daily essentials are more likely to make higher-margin purchases (like electronics) within the same app. The ability to offer an all-in-one platform for shopping, meals, and services is seen as the pathway to winning China’s enormous mobile-first population.

-

Competitive Environment:

-

The rivalry is stoking a fierce price war, with multi-billion-dollar subsidy campaigns driving down short-term profits in pursuit of long-term user loyalty.

-

-

Analysts see this as a shift from traditional online retail to a hyperlocal, on-demand economy, where speed of delivery and breadth of offerings will determine dominance.

-

Regulatory authorities have urged all players, including Alibaba, JD.com, and Meituan, to compete fairly amid concerns over unsustainable discounting and market behavior.

| Company | Amount Invested | Focus | Main Tactics | Strategic Aim |

|---|---|---|---|---|

| Alibaba | $7 billion | Instant retail & food delivery (Taobao Shangou, Ele.me) | Massive subsidies, discounts, integration of food & daily shopping | Cement Taobao as China's top everyday app |

| JD.com | $1.4 billion | National food delivery | Deep discounts, no-commission partnerships, hiring couriers | Rapidly grow market share, build an all-in-one ecosystem |

The Stakes

This surge in competition is reshaping China’s digital commerce landscape. By tying everyday purchases to their ecosystems—with aggressive financial backing—Alibaba and JD.com are betting that whoever delivers the most convenience and value will win the race to become China's true "everyday apperyday app

Comments

0 comment