views

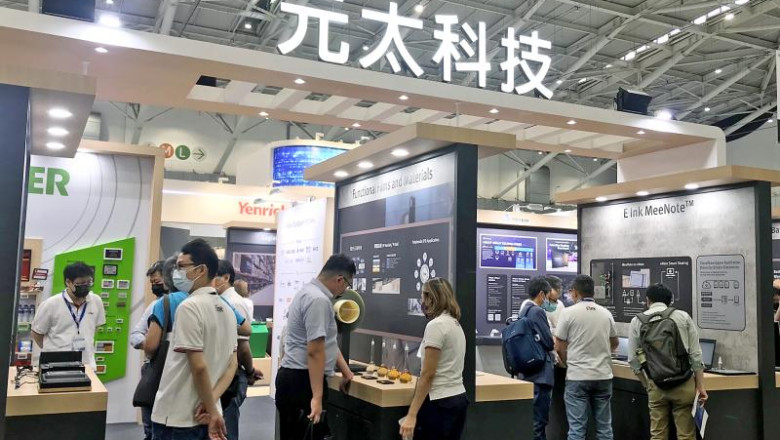

E Ink Holdings Inc (元太科技) yesterday said it would further expand capacity to cope with robust demand for e-paper displays used in e-readers, e-notes and electronic shelf labels, as the COVID-19 pandemic and rising inflation have not dampened consumer demand.

Although rising inflation is weakening companies’ purchasing power, E Ink said that its customers have not scaled down orders for e-paper displays used in e-readers.

“Reading is still the most affordable leisure activity that people have,” E Ink CEO Johnson Lee (李政昊) told an online investors’ conference in Taipei.

As e-books are less expensive than paper books, “we have so far not seen a slowdown in demand,” Lee said. “We are seeing quite robust demand.”

Demand was also aided by E Ink’s launch of better-performing colored e-paper display technologies to replace e-readers with monochromatic displays, Lee said.

Large-scale retailers are more rapidly adopting electronic labels due to price volatility and inflation, as well as higher labor costs and worker shortages, he said.

E-papers used in electronic labels, which replaced those used in e-readers, became E Ink’s biggest revenue contributor last quarter, accounting for 52 percent of the company’s total revenue of NT$5.96 billion (US$200.61 million), the company said, adding that this was a significant increase from 40 percent a year earlier.

To meet demand, E Ink said that it would double this year’s capital expenditure to more than NT$4 billion.

The firm is to launch three new production lines for e-paper displays this year, Lee said, adding that another new production line would be postponed until the first quarter of next year because delivery of the equipment had been delayed.

To boost production, E Ink might convert part of a new office building into a manufacturing site, he said.

The office building is to open next year, he added.

Lee said that the impact from COVID-19 lockdowns in China has been negligible.

The large-scale shutdowns in Shanghai did not spread to Jiangsu Province’s Yangzhou, where E Ink operates an e-paper display module factory, he said.

Transportation snarls have elevated logistics costs, but that is manageable, he said.

E Ink reported that net profit in the first quarter increased 25 percent year-on-year to NT$1.46 billion — the second-highest in the company’s history — compared with NT$1.17 billion a year earlier, while earnings per share rose to NT$1.28 from NT$1.03 a year earlier.

Operating profit margin jumped to 24 percent, from 22 percent a year earlier.

Gross margin this quarter is likely to decline, as shipments of lower-margin e-reader modules would increase ahead of the peak season in the third quarter, the company said.

Revenue in the first quarter rose 14 percent annually to NT$5.96 billion, the highest in 11 years, it said.

This week’s undoing of the TerraUSD algorithmic stablecoin and its sister token, Luna, has ramifications for all of crypto. First, there is the immediate impact: The rapid collapse of a once-popular pair of cryptocurrencies sent a ripple effect across the industry, contributing to plummeting coin prices that wiped hundreds of billions of market value from the digital-asset market and stoked worries over the potential fragility of digital-asset ventures. Then there are the knock-on effects. In addition to delivering punishing losses to individual users and investment firms, the spectacular failure of a market darling like Terra threatens to have a cooling effect

China’s biggest chipmaker has cut its outlook for the second quarter, joining a growing list of manufacturers warning about the fallout from lockdowns aimed at containing the country’s worst COVID-19 outbreak in two years. Semiconductor Manufacturing International Co (SMIC, 中芯) estimates a month-long lockdown in Shanghai could spur component shortages and logistics tangles, and erase about 5 percent of its output in the second quarter. “We are trying our best to mitigate the impact on product delivery,” SMIC Chairman Gao Yonggang (高永崗) told analysts on a call yesterday morning. “We are still assessing the actual impact as many suppliers restart their

DISRUPTIONS: The war in Ukraine, China’s lockdown measures, rising interest rates and inflation have thrown a wrench into business plans made years in advance Samsung Electronics Co is talking with foundry clients about charging as much as 20 percent more for making semiconductors this year, joining an industry-wide push to hike prices to cover rising costs of materials and logistics. Contract-based chip prices are likely to rise around 15 percent to 20 percent, depending upon the level of sophistication, people familiar with the matter said. Chips produced on legacy nodes would face bigger price hikes, while new pricing would be applied from the second half of this year, they said, adding that Samsung has finished negotiating with some clients and is in discussions with others. Samsung’s decision

material SHORTAGE: Even as workers are about to return, Quanta lacks operating supplies, while Pegatron reported its lowest revenues in 11 quarters, the companies said Taiwan’s major Apple Inc supplier cut its outlook for the second quarter, joining a growing list of manufacturers warning about the fallout from lockdowns aimed at containing China’s worst COVID-19 outbreak in two years. Quanta Computer Inc (廣達電腦), which assembles MacBooks, expects a 20 percent quarterly fall in notebook shipments and a squeeze on margins this quarter due to the lockdown, a company representative said on Friday during an earnings call. The impact from supply chain disruptions could last until the end of the year, she said. The company’s Shanghai factory has been operating under tight restrictions since the middle of last month,

Comments

0 comment