views

China’s eateries slash prices by up to half to woo diners hungry for value, but at what cost?

From hotpot to coffee, F&B brands have been slashing prices to attract increasingly budget-conscious diners in a competitive market. Analysts have questioned if such moves are sustainable, and whether they come with a catch.

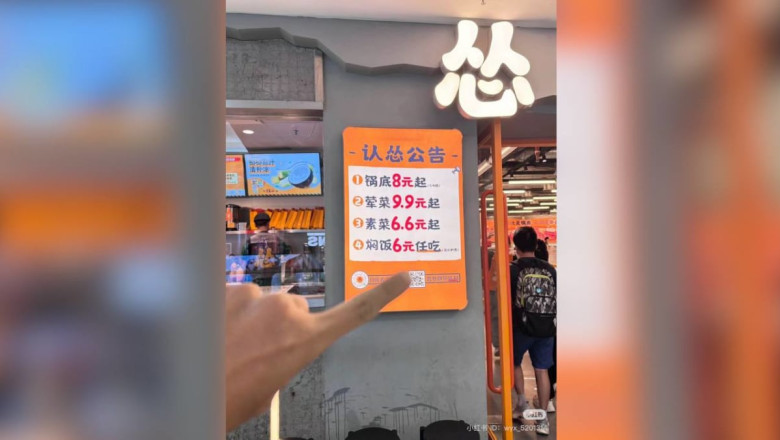

A notice by Song Hotpot Factory stating its latest price revisions. F&B brands in China have been slashing prices to woo diners hungry for value. (Photo: Xiaohongshu/吃货小张)

A notice by Song Hotpot Factory stating its latest price revisions. F&B brands in China have been slashing prices to woo diners hungry for value. (Photo: Xiaohongshu/吃货小张)

Four-hour-long queues are par for the course on weekends at a particular hotpot restaurant in Guangzhou, widely regarded as China’s food capital.

But customers such as Sammy Chen aren’t losing their appetites over the long wait times. The 22-year-old student averages at least one meal a week at Song Hotpot Factory, a brand under catering giant Jiumaojiu.

The food aside, what truly keeps her coming back is the lighter load on her wallet as the Chongqing-style hotpot restaurant chain slashes prices - an action mirrored by other food and beverage (F&B) brands in what analysts say reflects an ongoing price war.

In the latest adjustment by Song Hotpot Factory in June, the minimum prices for soup bases, meat dishes, and vegetable dishes were reduced to 8 yuan (US$1.12), 9.9 yuan, and 6.6 yuan respectively.

“The price has been reduced to about half of what it used to be. When I ate there in 2022, the average cost per person was around 150 yuan. But this year, after discounts, each person only needs to spend less than 100 yuan to be fully satisfied,” Ms Chen told CNA.

“The prices have indeed attracted a large number of customers. During peak dining hours the restaurant is usually full, and the waiting list can range from dozens to even hundreds of tables,” she added.

A competitive environment is pushing dining establishments to offer greater value to increasingly budget-conscious diners, especially as an economic downturn and rising costs drive more people to tighten their belts, observers say.

At the same time, they warn that continued price cuts might not be realistic from a business point of view. Eateries also need to ensure service standards and food quality are maintained, lest their reputation take a hit.

“Winners will be those who adapt quickly to new industry trends and are responsive to consumer demands with good service level,” according to Mr Daniel Zipser, who leads McKinsey’s consumer and retail work in Asia.

From hotpot to coffee, F&B brands have been slashing prices to attract increasingly budget-conscious diners in a competitive market.

Among them is high-end restaurant chain Hefu Noodle, which announced price cuts in June. According to local news outlet Beijing Business Today, a standard bowl of noodles costs between 16 and 29 yuan for members, nearly half the 40 yuan to 50 yuan ballpark when the brand was first established in 2012.

Meanwhile, popular Taiwanese-style hotpot chain Xiabu Xiabu announced in May that the prices of its new menu would "return to the old days".

Average set meal prices there have dropped by more than 10 per cent, reported local news site Guangzhou Daily, with a single meal costing 58 yuan on average while a double meal is priced at 130 yuan.

The developments have sparked discussion on Chinese social media platforms. “Hotpot prices are falling faster than the temperature of the broth,” a netizen quipped.

As local eateries slash prices, foreign fast food brands are also following suit. US fast food giant Burger King is pricing its signature burger at 9.9 yuan each, nearly a third of its original price, noted an Aug 4 report by the state-run Global Times.

On the coffee front, where a price war is said to be raging, Reuters reported in May that Starbucks has upped the number of discount coupons being offered in the country. Starbucks China CEO Belinda Wong had said in January that the company is “not interested in entering the price war”.

Analysts point out that the price cuts are aimed at drawing customers in as economic and labour market woes in the world’s second-largest economy take a bit out of consumer spending.

The current trend for diners in China is to seek value-for-money options, according to a research report by Daxue Consulting in April.

Of the 1,000 survey participants, 32.6 per cent viewed affordability as the top priority. The availability of specific dishes ranked second, followed by the overall environment of the restaurant.

The current trend of affordability is not a passing phase, and is a response to significant shifts in the market, said Ms Ashley Dudarenok, founder of China-focused digital consultancy ChoZan.

At the same time, she noted that consumer preferences in the Chinese F&B market vary significantly depending on the individual and the age group.

A survey by consulting firm McKinsey & Company completed at the end of 2023 found that consumer behaviours diverged significantly among different age groups in urban China.

The Gen Zs, aged 18 to 25, exhibit a more “optimistic” outlook on their financial futures, leading them to spend more on quality services that offer emotional and social value.

In contrast, the rising middle class in first- and second-tier cities, particularly those aged 26 to 41, tends to adopt a more conservative approach to spending, especially on F&B.

This is often due to their financial commitments, such as children's education and mortgage payments, said Mr Zipser.

Even as F&B businesses dangle discounts and promotions to give customers more bang for their buck, experts warn that such moves may not be sustainable in the long run.

Mr Zipser told CNA the impact on brand loyalty and long-term profitability remains uncertain, especially if lower prices come with a cost.

“Consumers are looking for value options, but compromising on service quality can quickly damage a brand's image,” he said.

Ms Chen, the hotpot regular who frequents chain restaurant brands, said that based on her observations, outlets rarely maintain portion sizes after reducing prices, even if the quality of food stays the same.

“For example, after Tai Er (known for its Chinese sauerkraut fish) lowered its prices, the portion size of its signature pickled fish dish became smaller,” she claimed.

Jiumaojiu acknowledged that the exclusive pursuit of low prices is “unsustainable” in a Jul 19 report by Chinese financial newspaper The Securities Times.

The catering giant added that it would instead “continue to enhance the product value-for-money ratio, aiming for a balance between quality and price”.

Similarly, Haidilao doesn’t see lower prices as the pivotal factor in attracting business, even as it comes out with more budget ventures.

Last year, the Chinese hotpot chain launched Xiao Hai Hotpot, which the company has said is aimed at providing affordable yet high-quality hotpot options. Customers have each spent under 80 yuan on average, it added.

On popular review and rating app Dianping, checks by CNA found that an individual weekday lunch hotpot set meal coupon at Xiao Hai Hotpot can be purchased for 54 yuan, while a kids’ meal coupon goes for as low as 0.9 yuan.

“But I think we need to break the notion that lowering prices will automatically bring more customers. I believe this idea is flawed because dining is a comprehensive experience,” a Haidilao source who does not want to be identified told CNA.

“Dining is fragmented, with many elements contributing to the desire to consume, not just whether something is expensive or cheap.

“Service is a broader concept. Service might include traditional acts like pouring tea for you, and it might also mean singing you a birthday song, making you feel emotionally fulfilled.”

Analysts say innovation is a key factor for F&B outlets to survive and even thrive in an unforgiving market.

There were 1.36 million restaurant closures and revocations in China all through 2023, according to the National Bureau of Statistics.

And in the first quarter of 2024, around 460,000 restaurants were deregistered or had their licences revoked, with around a 230 per cent year-on-year increase in restaurant closures. In March alone, 180,000 establishments shut their doors.

China’s high-end catering sector has been hit the hardest since 2023, noted Ms Dudarenok. She cited the decrease in business banquets, declining foot traffic in shopping malls and reduced discretionary spending as reasons.

Long-term leases are compounding pressures, she added.

“It is difficult to achieve cost reductions from the decrease in commercial real estate rent in the short term. With these pressures, in 2024, news of well-known restaurants closing down became frequent.”

High-end dining casualties this year include several known Western restaurants such as Refer in Beijing and TIAGO. The former closed its doors for good on New Year’s Day, while the latter closed suddenly in April, leaving customers unable to redeem their prepaid balances and some employees with unpaid wages.

Located in Beijing, Michelin-starred Italian restaurant Opera Bombana abruptly shut down in April as well. It was later revealed that the restaurant had defaulted on rent.

Still, China’s F&B industry remained resilient overall, official data suggests. National revenue reached 460.9 billion yuan in June, a 5.4 per cent year-on-year increase. From January to June, the sector generated a total of 2.62 trillion yuan, a 7.9 per cent year-on-year rise.

New endeavours have also been sprouting up. Among the nearly 15.73 million catering enterprises nationwide, more than 4.1 million were newly registered in 2023, with private firms accounting for over 80 per cent, industry data shows.

“New entrants face higher barriers, needing to excel in product, pricing, supply chain and management to succeed. This has led to an accelerated ‘survival of the fittest’ landscape, where strong companies strengthen their positions while weaker ones struggle,” said Ms Dudarenok.

For instance, Shanghai-based fast food retailer Yum China - which operates brands like KFC and Pizza Hut in China - posted record-high Q2 revenue at US$2.68 billion, up by 1 per cent year-on-year, despite “challenging industry dynamics”.

"Our sharp focus on value-for-money and innovative new products worked well, driving robust same-store transaction growth,” said Yum China CEO Joey Wat in the earnings statement.

The company highlighted “encouraging initial results” in several business model “breakthroughs”, including the Pizza Hut WOW store concept that’s aimed at attracting solo diners, young people, and more value-conscious customers.

Existing F&B players are finding ways to adapt, noted Ms Dudarenok - such as opening up to franchising, or expanding abroad in the hopes of breaking into new markets.

While there are clear benefits, these come with significant challenges as well, Ms Dudarenok pointed out.

“(Franchising) allows for faster expansion with less financial pressure compared to direct operation. However, it demands higher standards in supply chain management and franchisee oversight,” she said.

Meanwhile, expanding overseas requires adapting to different culinary cultures and preferences, and involves extensive market research and localised product adjustments.

Mr Zipser from McKinsey said exploring new revenue streams and incorporating local flavours in their offerings are among the innovations which can help chains stay competitive, coupled with a strong social media presence.

Ms Dudarenok highlighted the growing domestic consumer appetite for creative dining experiences. She cited examples in cities such as Luoyang, which introduced immersive dining events in the summer such as a beer festival and the "Luohun Whole Fish Feast" cooking competition.

The restaurant industry values repeat customers, she pointed out too.

“Before luring customers in with low prices as a ‘hook’, restaurants first need to consider how to provide customers with a consumption experience that exceeds expectations, making them feel it is worth it, and converting them into returning customers,” she said.

“Even if there are no such favourable prices next time, these consumers would be willing to return for the quality and experience.”

This quality experience is what BASTARD, a modern Chinese eatery in Shanghai, hopes to offer. A pandemic baby, meals there cost around 280 yuan to 350 yuan per person.

"The economy is down in China now so the price war is far more intense. We hear a lot of consumers now use the word ‘value’ when they’re finding restaurants to eat," said co-owner Jiro Hsu.

Still, she told CNA that they are standing firm on their prices.

“We do not have the leveraging power to (enact price cuts to the extent) the big brands or chains have, so lowering our prices would only lead to a worse outcome.”

“We always believe in good products or concepts … and that does need to come with a strong belief in what you’re doing.”

Prices are also not the main factor for Mr Damien Cabral.

“I think more of star ratings and comments, followed by top dishes. I like to try new things or innovative dishes that haven’t been done much before,” said the 30-year-old co-founder of an e-commerce brand who moved to Shanghai six years ago from Australia.

While pointing out “a lot of choices for that” in Shanghai, he acknowledged that “it’s not what the majority of people are doing”.

“(They just) don’t have enough disposable income,” he said.

Ms Chen, the student and hotpot enthusiast, holds a similar perspective.

“New experiences come first. I tend to choose restaurants I haven't been to before. Next, the cleanliness of the restaurant and the reviews of the ingredients by other customers are my main points of reference.

“After that, I pay attention to the service attitude of the staff and the music played in the restaurant. And finally, I consider whether the price is reasonable,” she said.

“But of course, what I care more about is the overall value for money - the balance between price and quality.

“In China, there’s a saying, 'food is the paramount necessity of the people’. Food is not just physical energy for me but also spiritual energy. Delicious food makes me happy.”

Comments

0 comment